It's that dreaded time again - doing up the income tax form. Argh!!!

I have just received my EA so it's about time to start meddling with the numbers. I hate to come to the final box to see how much they're taking away from me.

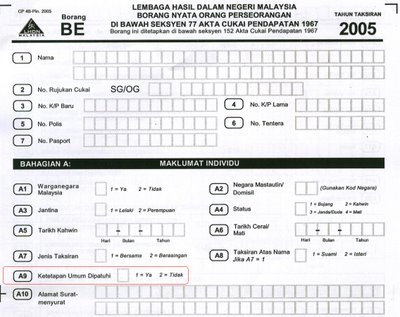

Anyway, Daddy Nick asked me what "Ketetapan Umum Dipatuhi" means on the form and I was a complete blur. I gotta confess I didn't even look at the form when I received it.

Digging out my Borang BE today, I found that particular section. I couldn't find the small booklet that explains all the items on the form. In fact, I don't even know if they sent the booklet because I only found the form without the envelope it came in.

So, some help needed here...anybody knows what it means and how to answer it? It's the part I've boxed up in red. Click on the image and enlarge it if it's too small.

I have just received my EA so it's about time to start meddling with the numbers. I hate to come to the final box to see how much they're taking away from me.

Anyway, Daddy Nick asked me what "Ketetapan Umum Dipatuhi" means on the form and I was a complete blur. I gotta confess I didn't even look at the form when I received it.

Digging out my Borang BE today, I found that particular section. I couldn't find the small booklet that explains all the items on the form. In fact, I don't even know if they sent the booklet because I only found the form without the envelope it came in.

So, some help needed here...anybody knows what it means and how to answer it? It's the part I've boxed up in red. Click on the image and enlarge it if it's too small.

4 comments:

i found someone who got an answer ... "just say yes, if u say no, u will be subject to tax audit".

then again, another person told me that the irb fellas told him to "say no, coz if u say yes and later become unlucky and you get audited, and your numbers don't tally, u will be subject to penalties".

and i finally found someone who really have the answer ... he said "you just say yes (if you are not self-employed). the reason?

if u say yes, u may get a tax audit if u are unlucky, and if the numbers don't tally, u will get a penalty and pay more tax.

if you say no, u are likely to get a tax audit. you may incur cost during the audit (e.g. have to spent time running around), and if the numbers also don't tally, u may not be penalised but required to pay the differential sum if you under-declared.

in both situations, you will incur more cost. saying yes reduces the risk of u getting tax-audited"

well, it's really up to you to say yes or no ...

like it or dont we have to do it.. lots of loop holes...lots of tax deduction....go for it

nick, thanks for the explanation. so "yes" it will be then. finished with yours?

foodcrazee, i agree with you, gotta maximize on the portion for rebates. time to dig out receipts from bookstores!

stargazer, thanks. i haven't done mine. lazy!!

Post a Comment